Table of Content

While a good credit score is helpful to get a traditional loan, it’s also a good idea to have one for a hard money loan. You can still get a hard money loan with fair or poor credit, but you might not get 100% financing. The first and most logical funding option for the buyer has to be a home loan. ‘How to get a 100 percent home loan’ is a question most first-time home buyers ask. Banks and other lending companies offer loans of up to a whopping 90% of the total value of the house property. Since then, the USDA's loan programs have been self-funded by a fee charged to borrowers.

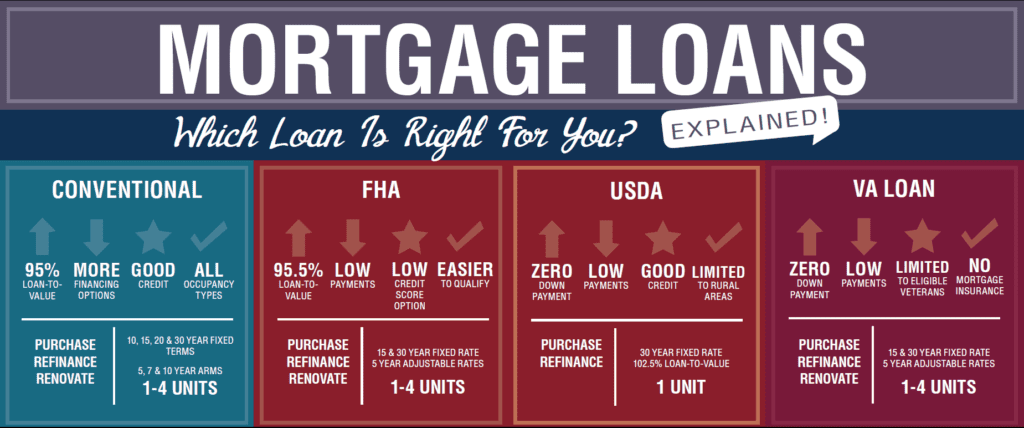

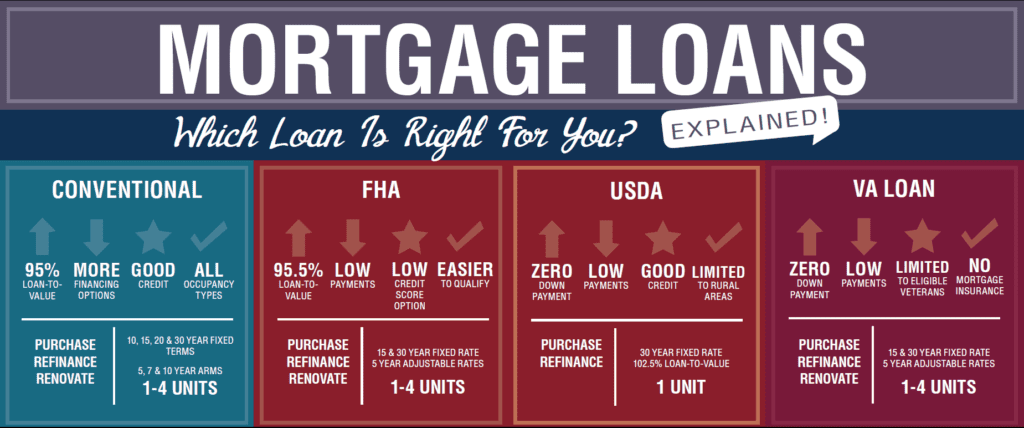

In general, you’ll have to pay mortgage insurance when you make a down payment of less than 20%. For example, when you use the VA loan, you won’t have to pay private mortgage insurance regardless of your down payment amount. The repayment requirements for down payment assistance loans vary. In some cases, you’ll have to repay the loan alongside your mortgage. In other cases, the debt will be forgiven if you meet certain requirements.

Managing Your Mortgage or Equity Loan

Both you and the property you want to purchase must be qualified for a USDA-backed loan. For you, there are household income limits based on the Area Median Income in the location where you hope to purchase. It's important to note, for instance, that the USDA's 100 percent financing is determined by the property's appraised value, not the sales price of the home. To see what other types of mortgages we have available, along with our specialized mortgage programs, visit our Mortgage overview page.

Both of the loans will use your home as collateral, but a HELOC allows you the freedom to draw on those funds at any time for home improvement projects or emergency funds. The Guaranteed Loan program is funded through USDA-approved mortgage lenders and brokers. Like the FHA program, the USDA doesn't directly fund these loans itself but instead guarantees them, making them a safer investment for the lenders.

The Mortgage Loan Process in 10 Steps

It can be risky to deplete your entire savings to cover a down payment. Consult with your lender to learn what mortgage types you qualify for, and what down payment assistance programs are available. Homebuyer.com can help first-time buyers purchase their home with no down payment with multiple 100 percent mortgage financing choices. Some down payment assistance funds can apply to closing costs, too. There are several ways you can buy a house without spending thousands upfront. Homebuyer.com offers down payment assistance to first-time home buyers with an FHA mortgage.

Most lenders require PMI for home purchases with down payments that are less than 20% of the home's cost. However, Navy Federal doesn't require PMI at all on ourloan products. If you don’t qualify for either of those loan types, you can pursue a no money down mortgage through a combination of a low down payment mortgage and a down payment assistance program.

Can I get a mortgage with no money down?

With 1/1, 3/1, 5/1, 7/1 and 10/1 ARM rates so low it makes buying a home cheaper than renting in many instances. Buying and financing your first house is a big step in life, so it is prudent to take advantage of this government "took-Kit" to make the process less complicated than it needs to be. Find the Best Home Loan Offer for your situation regardless of your financial status. There are never any fees to compare quotes and there is never any obligation.

As a result of the new loan limit, Fannie Mae estimated in 2012, as many as an additional 466,326 homeowners would be eligible for a conforming loan. As with all mortgages, you are borrowing against the value of your home. If you default, you can risk having your home foreclosed on. Even if both are through Rivermark Community Credit Union, this is still an extra thing to keep track of. The 5/1 ARM will be cheaper than most ARMs for the first 5 years.

Best Ever Rates for Home Buying With interest rates hitting their lowest points of the century, home financing appears to be back in style. The Veterans Affairs Department guarantees 100% financing to all qualified military veterans in all 50 states. Rivermark Community Credit Union does require a credit score that is 700 or higher. As with all mortgages, if you sell your house, you must pay the remaining balance in full. However, normally, you would have made a down payment, so the balance needing to be paid would be lower. Since the entire value of your home was financed in this case, you would need to repay a higher amount.

Here are some of Nav’s top picks for hard money and fix-and-flip lenders. Use Nav to instantly compare your best options based on your unique business data. Create an account to find opportunities you’re most likely to qualify for fast. Looking to buy a home but don’t have the savings to pay the part not financed by a home loan. For very low-income families who own homes needing repair, the Home Repair Loan and Grant Program offers loans and grants for necessary renovations and maintenance. See HSH.com's Annual Market Outlook for 2023, our long-range forecast for mortgage rates, home prices, home sales and lots more.

Instead, contact Complete Lending and trust our long history and frank counsel. No matter what mortgage loan or consultation you’re in need of, you can count on us. However, one must note that the higher the loan amount, greater is the risk for the lender which is why interest rates may be higher and credit score requirements will be stricter.

They also offer 10-day funding time on smaller unit fix and flips, but this time may be longer for long-term loans or for ground-up construction projects. Overall, the simplicity of the application process and overall solid terms make LendingOne a great option. However, it’s always a good idea for any small business owner to establish and build their business credit scores as early as possible in their business journey.

No comments:

Post a Comment